The present work is protected by copyright in all its parts.

© 2021 by Heinz Hermann Maria Hoppe.

All rights reserved.

Comment

Author: Heinz Hermann Maria Hoppe

The value of a person is measured by the possessions: House, car, bank account, the current allowances and the investments. Money promises power. People gamble as if in a frenzy; they can never have enough. Profit and growth occupy thoughts and determine actions. Money has mutated from a means to an end.

A Colombian legend attracted the attention of Spanish conquistadors. In the 17th century, rumors circulated about a mysterious city of gold. In fantasies, it later became a golden land. Boundless greed drove the occupiers to the exotic jungle in the north of South America. In the name of the crown and under the protection of the cross, the invaders brought mass death by the sword, epidemics, torture and slave labor to the indigenous natives on numerous expeditions.1

Money is both a plague and a blessing. People have always killed for money. Not only base greed, but also sheer need drives the pursuit of quick fortune. In the hope of a few nuggets and some potato soup on the table, people flocked to North and South America, ready to spend years digging in the mud and living in board shacks for it. In the 19th century, thousands of workers left their European homes for California, Colorado and Montana, staking their claims and digging themselves underground, often forever.

In today’s ‘land of milk and honey’, corporations are not only digging for gold and diamonds, but also for petroleum, the ‘black gold’, for silicon and rare earths. Modern ‘gold mines’ include software development, pharmaceuticals and financial services. In the Silicon Valleys of this world, you don’t get your hands dirty. Dirt under the fingernails is also an exclusion criterion in the financial centers of power.

As nomads wandering hunter-gatherers owned only as much as they could carry. A conception of lack they did not know. Envy and resentment could not arise. Greed and fear of scarcity developed only in the homesteads of settled peasants and in walled communities. In such settlements the multiplying ‘Mammon’ was kept hidden and defended.2 Money got a venerable, quasi-religious nimbus as a universal medium of exchange.

The bull cult was reflected in the biblical dance around the Golden Calf. The worship of the shining bovine animal is considered since the appearance of the New Testament as an archetype of the Fall. The ‘twilight of the gods’, corrected by Moses, towards the only acceptable God, did not set in again until 3000 unbelievers had been slain as punishment.3

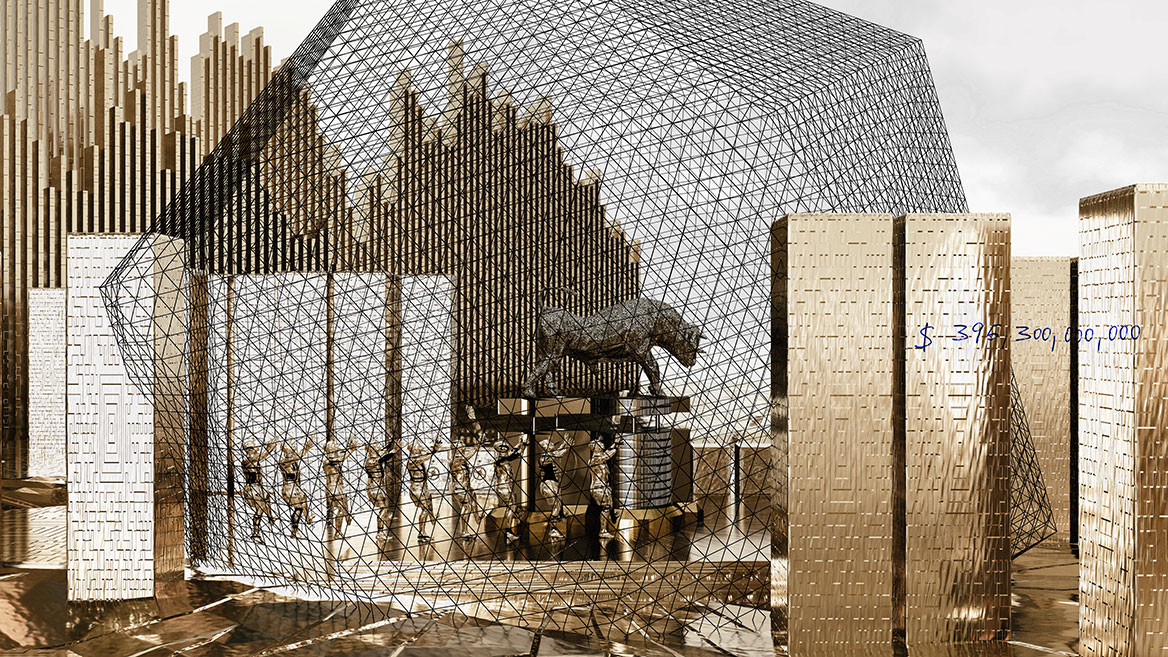

In our time, the idolization of money finds expression in the form of a, from a calf to a huge bull grown, symbol. In the stock market, people ‘dance around’ the bull market (bull market), which embodies the rise in stock market prices. The Wall Street in New York adorns itself with a belligerent appearing Charging Bull, which promises selected investors a pile of money.

World economic eruptions have exposed the vulnerabilities of financial systems in the form of financial crises and the catastrophic consequences. Stock market crash, global economic crisis, hyperinflation, dotcom crisis, sovereign debt – again and again, taxpayers are bailing out the effects of global speculative transactions by individual, insatiable ‘players’. Faster and faster, unimaginable sums of virtual money are spinning freely in networks around the globe and the risks of collapse are increasing. A ‘call for the last dance’ around the Golden Calf on the part of politics is not in sight.

For the symbolic representation of wealth and power, the motif of the bull is very old. No wonder, herds of cattle were and still are the living ‘capital stock’ of many nomads and farmers. In historical depictions, the Golden Calf was described as a symbol of moral and ethical decay. This interpretation originally established the Judean school of theologians of the Deuteronomists, whose prohibition of images put a stop to any form of depiction of God.

Nicolas Pousin painted the scene in The Adoration of the Golden Calf in 1633 to 1634, and Henri-Paul Motte interpreted the adored bull in 1899 with his painting The Dance of the Israelites Around the Golden Calf.4

The invention of the coin was a round thing. After such diverse currencies as shells, cloth, live chickens or tobacco, the agreement on a uniform medium of exchange simplified the movement of goods quite considerably and the means of payment was also no longer perishable.

Money is abstract. It doesn’t need embodiment in the form of coins, bills, or accounting printouts. It can also simply travel through fiber optic cables in the form of data. »Über 90 Prozent des gesamten Geldes – mehr als 400 Billionen Dollar auf unseren Konten – existieren nur in Computern«. (Free translation: More than 90 percent of all money – more than $400 trillion in our accounts – exists only in computers.)5 Cashless payments and cryptocurrencies are reinforcing the trend toward virtualizing money, even though the generation of Bitcoins has a high price tag in electricity.

Scarce goods are expensive, abundant goods are cheap. What is vital for everyone, like the air we breathe, is free. But it does not have to stay that way. Supply and demand determine the price. Where drinking water becomes scarce, for example, it is suddenly worth money. This could also be applied to the air we breathe. Where essentials become scarce and expensive, distribution struggles, civil wars and mass migrations are the result. CO2 already has a price today.

Money is no longer predominantly a medium of exchange for goods and commodities. »Von jedem Dollar, Euro oder Yen, der irgendwo auf der Welt zu Buche steht, wird heute nicht einmal mehr ein halber Cent für Brot, Bücher, Kleidung und Autos, für Löhne und Gehälter, für Maschinen und Rohstoffe, für Champagner und Villen im Tessin oder für Flugzeugträger ausgegeben!« (Free translation: Of every dollar, euro, or yen on the books anywhere in the world, not even half a cent is spent today on bread, books, clothes, and cars, on wages and salaries, on machinery and raw materials, on champagne and villas in Ticino, or on aircraft carriers!)6 »Die Liebe zum Geld als Selbstzweck hat sich zu einer globalen Seuche gemausert.« (Free translation: The love of money as an end in itself has become a global plague.)7

Corruption and scandals, bankruptcies and takeovers, record profits from speculative transactions and plummeting share values dominate the headlines. Power is concentrated in the hands of a few super-rich people, who have armies of ‘puppets dancing’. The most influential even take off with space programs all the way to Mars, while in famine areas of the earth, adult humans with less than 20 kg live weight huddle on the ground before finally dropping dead.

Where once only towers with attached crosses broke the horizon lines of cities, today rotating corporate logos on ever higher corporate pyramids illuminate the sky. People’s faith has shifted to new gods. The marketing departments of the ‘bigwigs’ manipulate the desires and buying habits of the ‘lemmings’. Consumption is ritualized, shopping has more meaning than a devotion for most people.

Many a manager knows responsibility only to his royalties. They willingly hold out both hands when it comes to state subsidies. Taxes and duties disappear at the same time in the ‘sleeves’ of tax havens. Particularly smart is the one who lets produce abroad with minimum wages, sells domestically with horrendous margins, privatizes profits and socializes losses. For the worst case one has provided and withdraws discreetly from the limelight on its yacht, with ‘appropriate’ reserves on the account of the wife. The fascination for high growth rates remains unbroken, the simultaneous whining great. ‘Growth without end’ is the unbroken slogan for free-market ‘sorcerer’s apprentices’.

Traders borrow money in low-interest currencies, ‘send it on its way’, and invest in high-interest currencies. The difference is the profit.8 Brokers act as intermediaries for investors. The money of the donors runs in ever more ramified alleys of the market. Processors and artificial intelligence now control how much is moved, reinvested and parked, and when. The ‘wires’ in high-frequency trading are glowing. Derivatives are gambled away. Stock hype alternates with steep cascades into ruinous valleys. Thousand percent increases in value overnight, exorbitantly increasing cryptocurrencies, real estate bubbles, the almost staid ups and downs of gold prices: The alternating currents of the stock markets have an effect on disappointed savings account adepts as if all the fuses had blown. But also financial experts and monetary guardians do not see through any more. The pursuit in the haystack becomes more difficult. In this way even ‘dirty money’ can be washed clean down to the pores on a grand scale.

The tough distribution battles behind the scenes result in ever new superlatives. The greed for more gives corruption and bribery a hand. Cyclical rolling and newly replaced managerial heads, deregulating, privatizing and cutting employee costs again and again, are addicted to fantastic profit prospects. That such deals are fraught with equally ‘fantastic’ risks is lightly brushed off the table. That one should only spend as much as one has taken in seems almost business-damagingly antiquated in these circles.

Investment banking is a ‘speculation roulette’. The stakes are called bonds, certificates, securities and interest. It is played by investment and hedge fund managers, bank executives, analysts and stock market gurus. Besides serious representatives there are ‘impostors’ who ‘trick’, for example with inflated balance sheets. In any case, some investors could never win so many games in a row so quickly with honest work.

In Greek mythology, Pasiphaë desired to be mated by the bull by whose appearance her husband had been elected king of Crete. Thereupon she gave birth to the Minotaur, half man, half bull. Held captive in the labyrinth, people had to be sacrificed to the monster regularly. Only with a ruse did the hero Theseus manage to kill the Minotaur and, shimmying back along the Ariadne’s thread, escape again from the labyrinth.9

The growth strategies of capital, established on the Western financial markets, have led us, among other things, to the climate crisis. For countless people, the globalized markets are ‘labyrinths of poverty’ and result in rural exodus. The same standard of living as in the West is not feasible for the overwhelming majority of the exploding populations, but is longed for. Who could blame the people? Still the ‘bull of Wall Street’ seems not to have shed its horns. We are spinning in circles at a dizzying pace, we continue to dance around the Golden Calf in a new guise. In the end, global, uninterrupted growth can only collapse.

The path through a labyrinth is a metaphor for the search for a new solution. Permanent changes of direction lead towards the self. Groundbreaking encounters with the self often lead to reorientation. A maze is not the same as a labyrinth, the path to be followed in a labyrinth is clearly given.10 We should promptly start searching for new paths in our ‘inner mazes’, towards more meaningful values. Experiences from our history could be valuable guideposts for us out of the dead ends of ‘money lust’ and ‘consumption frenzy’.

When our thoughts revolve almost exclusively around the multiplication of money, we lose sight of ourselves. This does not mean the people whose self becomes almost invisible because they have to turn over every penny. This does not mean the hard-working laborer who just about gets his family through. It does not mean the old, single woman who has to vacate her apartment of many years for a yuppie because she can no longer keep up with the rent increase. Meant are people whose possessions actually just weigh them down and whose management dominates their days. The ones who have to invest because of the adrenaline rushes and play poker higher and higher to keep the intoxication level up. Those whose overconsumption of luxury goods is sucking themselves and the earth dry. Those who would not have to work, but don’t know what else to do with their time and who keep putting off existential questions about personal happiness to the long bench in the boardroom. Good currencies in life, on the other hand, are values like happiness, love and divorce. This feels intuitively probably also every shareholder. Properly ‘invested’, its increase in value is without risk, lifelong and guaranteed.

German folk wisdom

Honest and reliable work is valuable.11 But work will become scarcer due to the 4th Industrial Revolution. Automation, digitization and artificial intelligence are advancing. As early as 1930, the British economist John Maynard Keynes predicted that in the early 21st century, 15 hours of work per week would be enough to live on – if we didn’t have such high expectations. But everything has to be bigger, nicer, faster.12 The realization that less and more equitably distributed work is better for people and for the planet will probably take some time. Without work, we feel worthless as humans, we’ve learned that way. For far too long, we have also internalized that you can make a lot more money much faster as a moneylender than if you put your full physical effort into it. Young people would rather study business than become carpenters.

Respect for customers and employees, the merchant’s honor and identification with the profession (or even the vocation) and the products sold have become rare. Human values are difficult to reconcile with opaque business, even if the word ‘values’ is printed in bold type in the company’s mission statement.

‘Cheap’ is not ‘cool’ and not worth the apparent advantage price. With cheap products we litter our home and our lives. Screwed together in third countries by children’s hands, they also rub off on our values. We get used to it. If there is no more interest on the savings, one could buy now instead desired things, at which one has long fun. The longer you can use them well in your life and enjoy them, which is guaranteed if they are of high quality, the more you get out of them in the end. The ‘interest earned’ in enjoyment would be a wise investment. We do not need much and more, but less good. Good things don’t have to cost more either. Many a tasteless villa facade reflects that a lot of money and good taste are not necessarily one.

After recently fetching nearly $70 million in cryptocurrency for a digital artwork by Beeple, the digital art market has been awash in a tsunami of blockchain data.13 The media-fueled burning of an original print by Banksy, followed by the auction of the digital version for even more money, was also ‘interesting’.14

Original and counterfeit have always been an issue in art. In the Internet age, digital plagiarism diminishes the livelihood of artists. However, the art market values not only artistic and certified originality, but also, in a unique way, the art of staging itself. Many an art dealer is as crazy as a schizophrenic broker.

Speculators are already using automated bots to bid for trade values of encrypted digital art. Non-fungible tokens or NFTs prove the authenticity of the work with cryptographic data. Proof comes at a price: huge power consumption for the many servers and exorbitant CO2 emissions. Blowing CO2 emissions caused by digital signatures into the atmosphere is not ‘timely’ in times of a climate crisis. It must become possible to encrypt in a more environmentally friendly way.

Authentication through encryption makes sense. The originality of a digital work can be clearly proven, compared to theoretically infinite reproductions. Technical reproducibility in art is not a new phenomenon, however. Walter Benjamin already dealt with the effects of copyable mass media photography, film and printing on art in his 1936 essay “The Work of Art in the Age of Mechanical Reproduction.”15

Collective hysteria not infrequently ends in a bubble. But the ideas of resourceful marketers are more sophisticated: digital art can be sold ‘fractionally’. The digital works are cut up and the individual virtual parts are sold – like concrete fragments of the Berlin Wall back then. Reassembled and presented in virtual exhibition halls, exorbitant sums are currently going over the counter – cashless in Ethereum currency.16 To match the virtual reality exhibition boxes, virtual ‘atmospherically relevant’ decorative seating can also be added, as with analog exhibition stand systems.

Online presentations of digital art ‘naturally’ fit the medium when the presentation quality of ‘walk-in’ virtual galleries reaches a level that far surpasses the feel of ‘baller games’. Virtual exhibitions should not try to imitate analog spaces, but, conforming to the online medium, should present them.

When show and hype are worth more than the actual work, there is a method to the madness and the performance is nothing more than a money printing machine driven by hot air. A toilet of pure gold, in front of which queues wait to empty themselves and superelevate their own excretions, reflects art values of the ‘occupants’ as well as the owners.17

When show and hype are everything and engagement with the actual works is nothing, there is a method to madness and the performances are nothing more than money printing machines driven by hot air. A toilet of pure gold, in front of which queues wait to empty themselves and exalt their own excretions, reflects at most the ‘ego values’ of the ‘occupants’ as well as the owners.17

Art values locked in alarm-secured safes cannot be seen. They are withdrawn from view and degenerate into nothing more than an investment that loses true art value every day they cannot be looked at. Pictures were and are not painted to be locked away, but to be looked at.

Demonstrations, protests, strikes, civil wars, and international conflicts - the climate crisis and the disconnected will cost immeasurably more. The Occupy- and the Fridays For Future movements are just the beginning. The consequences of our wasteful lifestyles are becoming increasingly visible. No amount of money in the world can revise the consequences and ‘buy back’ paradisiacal natural areas, insects, amphibians, birds and mammals once extinct. A single virus adaptation just shows how expensive broken nature is. Pure prestige projects do not save a single child from hunger and dehydration. In ‘poor countries’ full of mineral resources, elites skim off the profits and celebrate pool parties, while their own people die of thirst in oil-contaminated steppes. Public treasures such as drinking water, cultural assets and mineral resources belong to the inhabitants, not to cliques of disloyal elected officials. It is the moral obligation of treaty and trading partners to insist on equitable distribution.

The greatest grievances in the world are the result of greed for money and abuse of power. More and more growth does not make the rich happier. Littered seas make everyone poorer. If we don’t manage to distribute money more fairly and spend it on vital problems instead of luxury items and weapons, we will drive even more masses of people to flee to Europe and North America. The gap between the rip-off rich and the starving poor is far too wide. Growth without end has come to an end. Either we change or we will be forced to change.

Poverty has scourged mankind for millennia. ‘Rich and poor’ should finally be abolished. It may seem naive and utopian, but human societies have not always been insatiable. The combination of rotting food mountains with simultaneous famines, globally established management methods and logistics know-how are a modern disgrace. Instead of striving for money and power, larger ‘accounts’ of humanity, sense-making, knowledge, life experience, awe and trust, philosophical exchange, craftsmanship, enjoyment of art and culture would make us much more blissful. Ownership isn’t just great, it’s a burden. Exploring effective and more equitable distribution mechanisms would pay off intercontinentally for all people. Going to the bakery in an SUV and to the gym in the evening is absurd. In urban societies, everyone pays for the decadent luxuries of individuals. When do we try something new and practice happiness-inducing lifestyles?

»Klimaschutz ist eine Kunst der Unterlassung und nicht des zusätzlichen Bewirkens […].« (Free translation: Climate protection is an art of omission and not of additional action […].)18 ‘Online lifestyle status maintenance’, continuous ‘party time’ and the search for the next weekend kick create leisure time stress. When will we finally take time for deep reflection? When will we get to the real questions of our existence and our history? ‘Having’ is not the answer to our innermost longings and search for fulfillment. What money can do to people is researched and known. We should finally grow up and stop our ‘dance around the Golden Calf’.

»Sie leiden an einer Krankheit des Herzens, die nur mit Gold geheilt werden kann«. (Free translation: They are suffering from a disease of the heart that can only be cured with gold)19 the Spanish conquistador Cortés is said to have replied to the Aztecs, who wondered about the invading Spanish addiction to gold. »In Wirklichkeit handelte es sich […] nicht um eine Herz-, sondern um eine Geisteskrankheit […].« (Free translation: In reality, it was […] not a heart disease, but a mental disease […].)20

Note: The image titles are derived from a ranking of the world’s most valuable companies.

List of sources and literature:

1 See Eldorado. In: Wikipedia, The Free Encyclopedia. Date of last revision: April 20, 2021 18:48 UTC. URL: https://en.wikipedia.org /w/index.php?title=El_Dorado&oldid=1018948391 (Date retrieved: April 19, 2021, 15:47 UTC).

2 See Seeburg, Carina: Der große Betrug in: Süddeutsche Zeitung No. 77 from April 3/4/5, 2021, Wissen (Knowledge), P. 33.

3 See New Testament: The Book of Acts of Paul (The speech of Stephen).

4 See Golden calf in: Wikipedia, The Free Encyclopedia. Date of last revision: April 20, 2021 11:50 UTC. URL: https://en.wikipedia.org /w/index.php?title=Golden_calf&oldid=1018881195 (Date retrieved: April 22, 2021 15:56 UTC).

5 Harari, Yuval Noah: Eine kurze Geschichte der Menschheit, Pantheon Verlag in der Verlagsgruppe Random House: 34. Edition 2013, P. 219.

6 Blüm, Norbert: Ehrliche Arbeit. Gütersloher Verlagshaus in der Verlagsgruppe Random House: 2. Edition 2011, P. 29.

7 Ibid., P. 51.

8 See ibid., P. 47.

9 See Minotaur. In: Wikipedia, The Free Encyclopedia. Date of last revision: April 20, 2021 18:55 UTC. URL: https://en.wikipedia.org /w/index.php? title=Minotaur&oldid=1018949525 (Date retrieved: April 22, 2021 19:44 UTC).

10 See Simon, Violetta: Wo der Minotaurus hauste in Historie/Gesellschaft (History/Society), Süddeutsche Zeitung No. 54 from March 6/7, 2021, P. 51.

11 Blüm, Norbert: Ehrliche Arbeit. Gütersloher Verlagshaus in der Verlagsgruppe Random House: 2. Edition 2011.

12 See Seeburg, Carina: Der große Betrug. Ibid.

13 See Reyburn, Scott in: Art’s NFT Question: New Frontier in Trading, or a New Form of Tulip? The New York Times, online edition from March 30, 2021, updated April 13, 2021. https://www.nytimes.com/ 2021/03/30/arts/ design/nft-bubble.html? searchResultPosition=1 (Date retrieved: April 20, 2021 11:55 UTC).

14 See Scheer, Ursula Hurra, hurra, der »Banksy« brennt in: Frankfurter Allgemeine Zeitung, Feuilleton/Kunstmarkt (Feuilleton/Art Market) from March 11, 2021. https://www.faz.net/ aktuell/feuilleton/kunstmarkt/ digital-kunst-burnt-banksy -als-nft-fuer-380-000- dollar-versteigert-17238599.html (Date retrieved: April 20, 2021 12:26 UTC).

15 See Walter Benjamin. In: Wikipedia, The Free Encyclopedia. Date of last revision: April 13, 2021 05:45 UTC. URL: https://en.wikipedia.org/ w/index.php?title=Walter_Benjamin &oldid=1017512177 (Date retrieved: April 22, 2021 10:54 UTC).

16 See Reyburn, Scott in: Art’s NFT Question: New Frontier in Trading, or a New Form of Tulip? Ibid.

17 See Trinks, Stefan Goldiges Örtchen in: Frankfurter Allgemeine Zeitung, Feuilleton from January 26, 2018, updated January 28, 2018 https://www.faz.net/ aktuell/feuilleton/ das-goldene-kunstwerk- fuer-das-weisse-haus- 15418840.html (Date retrieved: April 20, 2021 13:05 UTC).

18 Paech, Niko in interview with Edenhofer, Ottmar. Bauchmüller, Michael and Weiss, Marlene: »Da rennen Sie in eine Falle« in: Süddeutsche Zeitung No. 72 from March 27/28, 2021, Wissen (Knowledge), P. 33/35.

19 Francisco López de Gómara, Historia de la Conquista de Mexico, Vol. 1, hrg. v. D. Joaquin Ramirez Cabañes (Mexiko-City: Editorial Pedro Robredo, 1943), P. 106. Quoted from Harari, Yuval Noah: Eine kurze Geschichte der Menschheit, Pantheon Verlag in der Verlagsgruppe Random House: 34. edition 2013, P. 213.

20 Harari, Yuval Noah: Eine kurze Geschichte der Menschheit. Ibid.